vat refund france louis vuitton How Much is the VAT Refund in France? For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet . Mud Box with One-Gang Ring Mud Boxwith Two-Gang Ring Mud Boxwith 4 Square Ring • 4 Square Ring not for luminaries. Mud Box Assemblies E42728 E42728 Part. No. Size Std. Ctn. Qty. Std. Ctn. Wt. lbs. A863BC Mud Box w/ Blank Cover 24 12.3 Patent Pending Part. No. Size Std. Ctn. Qty. Std. Ctn. Wt. lbs. A863CF Mud Box w/ Ceiling Ring 24 15.5

0 · tax refund galeries lafayette

1 · tax refund france minimum

2 · paris tax refund calculator

3 · le bon marche tax refund

4 · is hotel vat tax refundable

5 · how does vat refund work

6 · france tax refund calculator

7 · claiming tax back in france

At LV=, we want to help you to find the right car insurance at the best price. Just because you may find it cheaper elsewhere, it may not necessarily provide you with everything you need. For a complete list of what's needed and why, visit our guide to what you need to get a car insurance quote .

The Vat Tax refund on average takes 30–90 days to process. If you are traveling to Paris and go shopping during the busy season, I've seen the refunds take 6 months. If you are traveling to .

How Much is the VAT Refund in France? For France, it’s technically supposed to be 20% but tourist rarely get the full VAT back since companies like Global Blue and Planet . But what country offers the absolute best tax-refund for Louis Vuitton bags? We’re going to help make it easy for you with our handy table, which provides all information on VAT percentage amounts for several .

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles .

As a visitor to France, you may be eligible to buy goods tax-free and get a refund on the Value Added Tax (VAT) you paid during your stay. This guide will walk you through the process of obtaining a VAT refund step by . The best way to maximize your VAT refund is on larger purchases like luxury items or a group of items at one store. Buy something made in the country you’re visiting. Purchasing a Louis Vuitton purse in France will save .To be entitled to a tax refund, you must present the duty-free slip at customs on leaving France. You may be asked to produce the objects purchased so that they can be verified. You can easily obtain an electronic duty-free slip by using the .You are eligible to receive VAT back on the bag, but not the shoes, since the shoes don’t reach the €100.01 threshold, and the price can’t be combined with the purchase from Louis Vuitton {they prepare their own tax forms}.

So, how much VAT back can you get from Louis Vuitton in France? Well, it depends on a few factors, such as the type of product you purchase, the price of the product, and whether or not you are a resident of France. Generally speaking, you can get a refund of up to 12% on the VAT for most Louis Vuitton products. Hello, We plan on honeymoon-ing in Europe and I'd like to get a LV purse while we're there. Our itinerary is as follows: Fly into London > Take train to Paris > Fly into Vienna, Austria > Take train to Budapest > Fly out of Budapest to LHR to the US.. I would like to purchase a LV purse in Paris, but I've heard that within Europe you're not eligible for the VAT refund.

1. Does Louis Vuitton offer VAT refund? 2. Can you claim VAT in Louis Vuitton? 3. How do I get my Louis Vuitton tax free? 4. How much is the VAT refund in Paris LV? 5. Is Louis Vuitton tax free in Paris? 6. How much .

tax refund galeries lafayette

tax refund france minimum

swiss rolex milgauss replica

Take Louis Vuitton Onthego GM in Monogram Reverse Canvas. It's ,250 in the US. With tax, it'll turn to be at least ,412. In Europe, the same purse is 2 400€ (approximately ,400 in USD). With a VAT refund, the price declines even further, totaling at ,280.For an immediate VAT refund, you should present all your documents at the tax refund desk at the airport, the port or the train station from which you are departing. Otherwise, you must send the documents by post to a tax refund office such as Detaxe SAS, Global Blue France or Detaxe.com. > More info: Tax-free purchases with Pablo VAT refund in Italy. In Italy, the standard VAT rate is 22%.After deducting the administrative fee and the fee of the tax refund company, you’ll expect to receive an 11%-15.5% refund rate of your purchase amount, depending on how much you spent. And Italy also has one of the highest minimum spending requirements (€154.95).To get a tax refund, you’ll need to .

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. Track your refund, enjoy exclusive deals, and elevate your collection with the savings. Get expert tips for a seamless tax-free shopping .Beware that if you want a VAT refund in cash, the refund is limited to €1000 for each store you purchased from. I made 2 separate purchases from Chanel. For one purchase, I was refunded €600 in cash at the airport. This is the official guide to calculating the VAT refund in Japan. There are a LOT of information out there about what percentage you actually get back and I thought I would finally write a blog post so you don’t have to wonder where those extra dollars went. This is from my personal experience at Goyard Japan and I’ve recently visited a Louis Vuitton store in .

How much VAT is refunded in Italy? Although many products hold a VAT as high as 22%, tourists will not receive a full refund of 22% on a given good. There are administrative fees, and the actual refund amount or percentage may differ case by case. However, there’s a piece of good news.In short the answer is no, as of Jan 2021 the VAT tax refund policy in the UK will be eliminated. That means you will no longer be able to take advantage of the VAT Tax Refund in the UK. As you know, I love shopping and love designer handbags. When I first heard the news of the VAT tax refund being eliminated in the UK, I was shocked.

If we add the VAT refund (in Louis Vuitton it was 10%), then I’d get an additional 2 off, bringing the reduced total to 0 cheaper. When the sales associate explained everything to me I was so excited, but when she said I needed my passport I was definitely unprepared. Even though I wasn’t able to get the VAT refund because I didn’t .

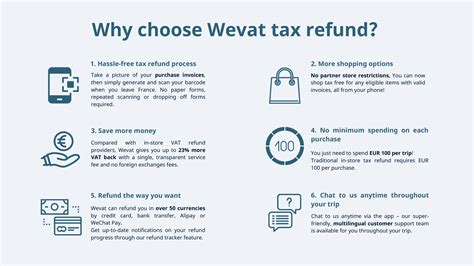

PurseBop shares her tips and advice for shopping abroad with an in-depth look at the VAT Refund Procedure in Europe and US Custom Duties. About PurseBop; . and Louis Vuitton, prices are often lower compared to other regions to maintain loyalty to the domestic consumer base. . In France, VAT ranges from 5% – 20% depending on the item. For .Few pointers: 1- I'm certain this 12% VAT refund isn't applicable on vintage stores like Monogram and Collectors Square. 2- I'm an Indian citizen, so I don't know how this VAT system works for EU residents. 3- Diners Cards aren't accepted for the refund so better to have a Visa or MasterCard. I didn't check for Amex. Hope this helps.To get a VAT refund with Wevat on your shopping in France, you will need purchase invoices addressed to Wevat for your goods. This is known as a " facture" in France. Most retailers in France offer factures , but there are a few that don't (for example, Louis Vuitton).

Working in an Embassy in Ireland? You don’t qualify for a European Union VAT refund via the process outlined above. However, you can claim VAT back via your protocol officer. 4. Other situations that don’t qualify . The main reason, however, to buy your next Louis Vuitton piece in Paris is because of the VAT tax refund, i.e. the sales tax refund! All European countries have a system in which you spend over a certain amount of money, .13 votes, 28 comments. true. Just returned from Paris 2 days back. The automated scanners for vat refund forms took a total of 2 minutes for me.In order to receive the full, 19.6% VATrefund--you would have to '..jump-through-the-hoops..' of the VAT refund process when you departed France, by having your VAT refund form verified by a French Customs officer and mailed to the appropriate government agency. The 'catch' to this is the Customs verification process.

Now, if you’re wondering why the connection between Louis Vuitton and France matters for your shopping expedition, here’s the 411. France is not just the birthplace of Louis Vuitton; it’s its home, its heart, and some might argue, the best place to experience the brand. . After getting your VAT refund amount at the airport, your Louis .

Example #2: Louis Vuitton Ombre Blossom Ring. The ring costs 2,100 euros and it hit my credit card at ,271.78. My VAT refund was pretty fast and I got 8.86 back onto my credit card within a couple of days. . So after doing all the math, it looks like if you do your VAT refund in France with a credit card, you only get about 10%-11% back . Let’s do some handbag math. The Noir Kelly 25 Retourne in Togo price in Paris was €7400. We received a 10% VAT refund, but had to pay 3.5% duty in US Customs. Effectively, we received a 6.5% refund of €481 bringing the total cost to €6,919. Using the exchange rate at the time of 1.02 euros to the dollar, we paid ,057.38 for the Kelly.

There are 3 main reasons that Louis Vuitton is cheaper in Paris, the first reason is the VAT Tax Refund that is available in EU countries including Paris, France. If you spend more than 100.01 Euros at Louis Vuitton you qualify for the VAT Tax refund in Paris, which is a saving of an additional 12% which is applied to your credit card 30–90 days after leaving the EU. Louis Vuitton Paris Price: 1,250 Euros (or ~,450 USD) Mainland U.S. Price: ,690 + 0.55 (9.5% Los Angeles Sales Tax) = ,850.55 USD; VAT Refund (~12% Back on Credit Card): 150 Euros or ~4 USD; Price After VAT Refund: 1,100 Euros or ~,276 USD; Louis Vuitton Paris Savings: ,850.55-,276= ~ 4.55 (~31% off)

Louis Vuitton U.S.A site; Louis Vuitton Japan site . Conversion Rate and VAT Refund Amount. For the conversion rate, I’ll be using USD = 149 JPY. For the VAT refund amount, I’ll be using a rate of 7% back if you are planning on using a VISA or Mastercard. How Did I Get the 7% VAT Refund Number?

Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Travel with family. The United States allows 0 per .LOUIS VUITTON Official International site . France +33 9 77 40 40 77. Book an appointment Next appointment available: . Fragrance Fountains; Concierge service; Complimentary WIFI; Tax refund issue : For eligible persons only and with presentation of the original passport or an official document proving the residence outside the European .

top ten rolex replicas for sale

paris tax refund calculator

Discos De Freio Carbono Carretilhas Shimano Antares Dc7 Lv. R$ 69. em. 12x. R$ 6 71. Frete grátis. SHIMANO. Shimano Antares Md Dc 2023 - Hg. R$ 7.500. em. 12x. R$ 720 88. Frete grátis. SHIMANO. Capa Protetora Carretilha Perfil Baixo Shimano 820a Neoprene. R$ 132. R$ 98 25% OFF. em. 12x.

vat refund france louis vuitton|is hotel vat tax refundable